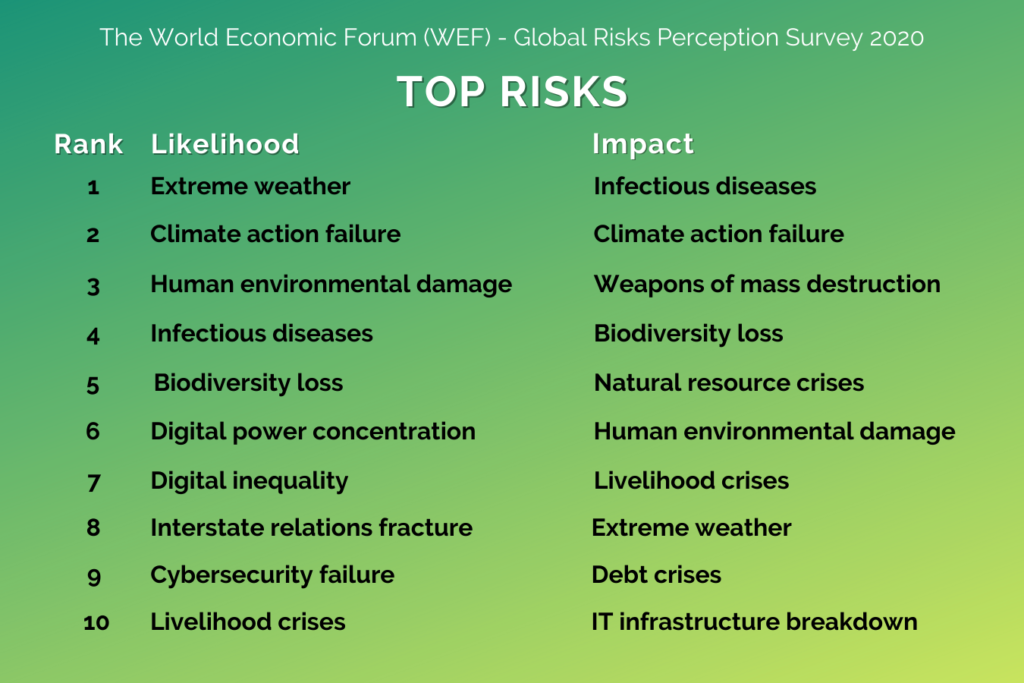

The World Economic Forum (WEF) – Global Risks Perception Survey 2020, the survey participants identified these key risks which are likely to have a direct impact on populations and thus affect businesses and livelihood.

As you may note, infectious diseases are ranked as the #1 risk in terms of impact and #4 in terms of likelihood; climate change is ranked as #2 in risk in terms of both likelihood and impact; and extreme weather is ranked #1 in risk in terms of likelihood but #8 in terms of impact.

The impact of the COVID-19 pandemic is likely to stay as a game changer continuing to adversely affect all aspects of our lives for most of 2021, especially business interruption.

Events, big or small, can have a strong effect on economies resulting in organizations struggling to identify and manage their risks. Given increasingly uncertain circumstances in a disruptive world, managing risk well will bring greater certainty into the organization’s planning and activities. From day-to-day management through to events such as logistic disruptions, political unrest, large scale data breaches and unprecedented nationwide lockdowns.

Although they attempt to pivot to the greatest extent possible, the majority of organizations often overlook their key potential threats and opportunities, and rely on their insurers, contractors, vendors, and suppliers to manage these risks.

Effective risk management enables organizations to make informed decisions and to achieve their objectives by continually assessing risks to reduce surprises, avoid poor performance, but allows them the agility to recalibrate new risk measures and seek new opportunities as they emerge. Risk management also provides relevant stakeholders with continuous, consistent, and reliable information.

Designing a “fit-for-purpose” risk management framework involves understanding how the organization creates, delivers, captures, and protects value. For example, the design may include investigating and understanding its purpose, strategy, objectives, decision-making processes, current risk management practices, needs and desired outcomes. Also asking questions such as “how are we currently managing risk?” and “what outcome do we want to achieve that we currently aren’t achieving?” can help determine the rationale for change to improve the risk management practices of the organization.

Diligent risk management allows the nature of individual risks and the interaction between risks should be identified and understood to support informed decision-making, and better recognition of potential unintended consequences of decisions. Developing and evaluating alternative scenarios reduces uncertainty in decision making and illuminates unknowns that can occur. Time frames and the extent of impact on the organization determine the criticality of decision-making processes.

Risk criteria are a set of rules or statements that enable consistent decision making throughout an organization. The use of risk criteria supports better decision making. Risk criteria can differ for various types of risk and should be compatible with the maximum risk exposure that the organization is willing to take. An organization can set criteria taking into consideration its priorities, for example the three dimensions of sustainability (environmental, social, and economic).

By conducting and documenting appropriate risk management practices, an organization can demonstrate due diligence and thus successfully fend off any liability claims by key stakeholders and seize opportunities, including attracting new and additional investors.

The post-pandemic world necessitates and allows the opportunity for acceleration to reassess the organization’s business model and its risk management (RM) strategy. Organizations that manage risk well not only survive but thrive. Risk management is the type of business continuity assurance mechanism that always pays (out) much more than it costs.

Awad Loubani

Senior Advisor